Top of mind –

Brazilian bonds - Hidden opportunity in Latin America?

After reacting swiftly to market volatility by shifting a portion of our clients’ capital into cash and defensive assets, we are now eyeing opportunities to redeploy the cash in areas of the market offering attractive returns.

Brazilian bonds pose a potentially attractive investment opportunity

Economic reforms have strengthened Brazil’s fiscal dynamics

Brazilian real outperforms US dollar and the pound

After reacting swiftly to market volatility by shifting a portion of our clients’ capital into cash and defensive assets, we are now eyeing opportunities to redeploy the cash in areas of the market offering attractive returns.

One area of the market we have identified is Brazilian fixed income – specifically, Brazilian government bonds. Two-year bonds are currently yielding 11%-12%, making them a potentially attractive opportunity.

Background

The Brazilian economy, like other commodity-producing emerging markets, has struggled since the so-called commodity super cycle ended in 2011. Low commodity prices, low GDP growth, and past free-spending Brazilian governments have led to its debt-to-GDP exploding from 51% in 2011 to 80% at time of writing. These high debt levels made international investors wary about investing in Brazilian fixed income. As a result, Brazilian bond yields have remained high for several years.

Economic reform

Since 2016, however, the government has enacted several economic reforms, including a pension reform, which raises the retirement age and increases workers’ contributions, a move designed to reduce the fiscal risk to Brazil. More flexible labour policies have increased employment, which has spurred growth. Crucially, during the covid pandemic, Brazil did not add as much debt compared to most nations. Although the country’s debt-to-GDP remains high, Brazil’s fiscal dynamics are stronger than some of its peers.

These fiscal concerns that have been plaguing Brazil for years mean bond valuations are quite low. In other words, the bonds are inexpensive and offer high yields, rewarding international investors willing to invest in emerging market debt.

Inflation

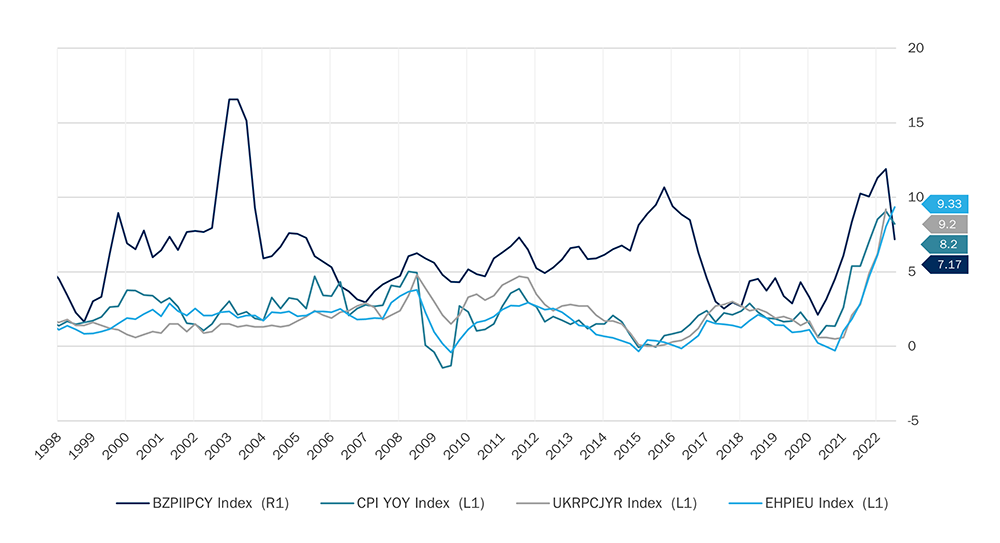

Brazil is no stranger to high inflation. It is a different story for some developed economies, such as the United States, the UK, and Europe, all of which are experiencing surging inflation for the first time in decades.

Surging inflation

Source: Bloomberg 13 Oct 2022

Given its history with high prices, the Brazilian Central Bank has been more aggressive in raising interest rates this time around. Brazil’s interest rates stand at 13.75% after 12 consecutive increases. Meanwhile, the Federal Reserve, Bank of England, and European Central Bank have been much slower in raising rates.

These hikes put Brazil ahead of the curve in its fight against inflation – indeed, the base rate in Brazil is among the highest in the world. The rate hikes should cool the economy, and eventually help bring inflation down. Once inflation eases, the central bank will not only pause interest rate hikes but introduce some cuts. Some banks forecast this could happen as early as 2023. A cutting cycle could lead to strong returns for Brazilian bonds. Since real yields – the yield less inflation – remain high, bond investors could receive more compensation compared to those holding developed market bonds, where real yields are low.

Local economy

The other source of return is the local currency. The Brazilian real, which is one of the cheapest currencies in the world, has outperformed the US dollar so far this year by 7% and the pound by 31%. As a major commodity producer, the real tends to perform well when commodity prices rise and lag when commodity prices decline. Commodity prices are expected to stay high given supply constraints globally, which bodes well for the Brazilian currency.

Brazilian Real Outshines Dollar, Pound, and Euro

Source: Bloomberg 13 October 2022

Conclusion

Investing in emerging market debt comes with risks. Some investors question whether the potential return of left-leaning Presidential candidate Lula da Silva may weigh on the recent economic reforms. Lula, the two times former president, received 48% of the votes needed to win in round one. But several Brazilian fund managers feel that since Lula has been president before, he is less likely to disrupt markets. They also note there is a major law in Brazil that curbs unfunded government spending. This reduces the fiscal risk.

While politics may play less of a risk, there is always the unpredictability of currencies. Should the real depreciate, it could lead to reduced returns.

However, we believe Brazilian bonds, which are offering double-digit yields, coupled with the improving inflation picture, could reward bond investors near-term, outweighing the potential risks.

Related services

Wealth Management • Investment Management • Financial Advisers

DISCLAIMER

This document is provided for information purposes only. It does not constitute advice, a solicitation, recommendation or an offer to buy or sell any investment, banking or lending product or service.

The contents of this document are based on opinions or conditions as at the date of writing and may change without notice. To the extent permitted by law or regulation, no warranty of accuracy or completeness of this information is given, and no liability is accepted for its use or reliance on it.

Author -

Suzy Waite

Investment Writer, Arbuthnot Latham

Suzy joined Arbuthnot Latham in 2021 from Bloomberg. An experienced financial journalist, she previously worked at Euromoney Institutional Investor and Haymarket Media. She’s covered a variety of areas including hedge funds, commodities, equity capital markets and asset management while living in New York, London and Hong Kong.

Working closely with the Investment Committee, Suzy covers committee meetings, client events and writes macro thematic pieces. She also contributes to flagship campaigns.